by Ameritax | Mar 22, 2022 | Tax Tips and News

It’s often said that computer security is everyone’s business, and now that’s truer than ever. With cybercriminals hatching scams and schemes at every turn, everyone—from taxpayers to tax professionals—has to stay on their guard to secure their computers, tablets, and phones against these cybercrooks.

The Internal Revenue Service works with the members of the Security Summit, made up of IRS and state tax agency officials and tax industry partners, to chart the strategies and methods to best protect taxpayer information and stop identity theft.

One of the best ways to succeed against identity theft is to educate users in the best methods to keep their networks and data safe and out of thieves’ hands.

The Big 10

The Security Summit has come up with 10 tips taxpayers and tax pros can use to minimize their exposure to fraud and identity theft:

- Safeguard personal data. Provide a Social Security number, for example, only when necessary. Only offer personal information or conduct financial transactions on sites that have been verified as reputable, encrypted websites.

- Protect personal information. Treat personal information like cash – don’t hand it out to just anyone. Social Security numbers, credit card numbers, bank and even utility account numbers can be used to help steal a person’s money or open new accounts.

- Use strong passwords. Use a password phrase or series of words that will be easy for you to remember. Use at least 10 characters; 12 is ideal for most home users. Mix letters, numbers and special characters. Try to be unpredictable – don’t use names, birthdates or common words. Don’t use the same password for many accounts and avoid sharing them. Keep passwords in a secure place or use password management tools.

- Set password and encryption protections for wireless networks. If a home or business Wi-Fi is unsecured, it allows any computer within range to access the wireless network and potentially steal information from connected devices. Whenever it is an option for a password-protected account, users should also opt for a multi-factor authentication process. Multi-factor authentication is critical to protecting your password.

- Avoid phishing scams. The easiest way for criminals to steal sensitive data is simply to ask for it. IRS urges people to learn to recognize phishing emails, calls or texts that pose as familiar organizations such as banks, credit card companies or even the IRS. Keep sensitive data safe and:

- Be aware that an unsolicited email with a request to download an attachment or click on a URL could appear to come from someone that you know like a friend, work colleague or tax professional if their email has been spoofed or compromised.

- Don’t assume internet advertisements, pop-up ads or emails are from reputable companies. If an ad or offer looks too good to be true, take a moment to check out the company behind it.

- Never download “security” software from a pop-up ad. A pervasive ploy is a pop-up ad that indicates it has detected a virus on the computer. The download most likely will install some type of malware. Reputable security software companies do not advertise in this manner.

- Use security software. An anti-virus program should provide protection from viruses, Trojans, spyware and adware. The IRS urges everyone to use an anti-virus program and always keep it up to date. Set security software to update automatically so it can be updated as threats emerge.

- Educate those less experienced about online safety. Children and those with less online experience may not be fully aware of the perils of opening suspicious web pages, emails or documents. Teens and younger users can put themselves at risk by leaving a trail of personal information for con artists to follow.

- Back up files. No system is completely secure. Copy important files, including federal and state tax returns, onto removable discs or back-up drives and cloud storage. Store discs, drives and any paper copies in secure, locked locations.

- Know the risk of public Wi-Fi. Connection to public Wi-Fi is convenient and often free, but it may not be safe. Hackers and cybercriminals can easily steal personal information from these networks. Always use a virtual private network when connecting to public Wi-Fi.

- Review ID Theft Central. Designed to improve online access to information on identity theft, it serves taxpayers, tax professionals and businesses.

A few other points to ponder when it comes to judging if a communication is real or a fraud. The IRS doesn’t use unsolicited email, text messaging, or social media when first contacting taxpayers about personal or financial information.

In most cases, the IRS will first mail a paper bill to someone who owes taxes. That said, the agency will sometimes call or make an in-person visit to taxpayers’ home or business “in some special situations.”

Remember, scammers posing as the IRS have one goal in mind; they’re trying to steal personal information.

There is, however, help for taxpayers.

There are ways to know if it’s really the IRS calling or knocking on the door. The IRS website, IRS.gov, has answers to questions, forms and instructions, and easy-to-use online tools.

Visit ID Theft Central for more information on thwarting tax-related identity theft.

Source: IR-2022-60

– Story provided by TaxingSubjects.com

by Ameritax | Mar 17, 2022 | Tax Tips and News

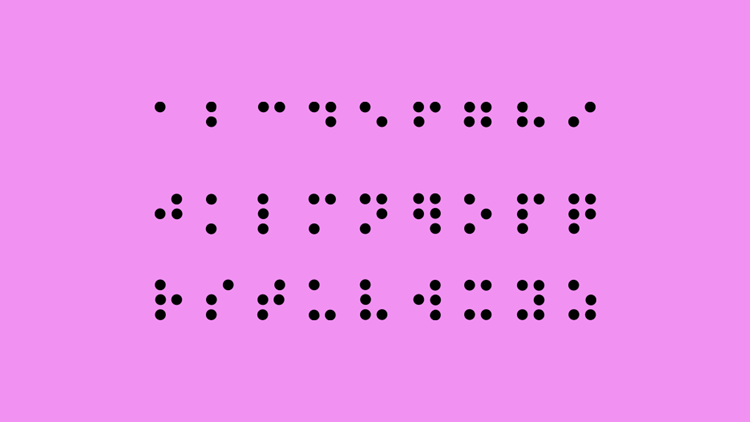

The Internal Revenue Service continues to ensure its forms, letters, and other publications are available to the widest number of taxpayers. The agency is now providing many forms and publications not only in Spanish, but in Braille, text, audio, and large print for Spanish speakers.

The IRS Alternative Media Center, also known as the AMC, has converted Form 1040 and its main schedules into Spanish Braille and large print, following through on the IRS commitment to make alternative-format documents and multilingual resources available to the taxpayers who need them.

To that end, the IRS has a Languages webpage where taxpayers speaking and reading one of 20 languages can find basic tax information, including how to pay taxes, how to check on the status of a refund, or how to file a federal tax return.

Commissioner Chuck Rettig sees all this as a real bright spot for his agency.

“It’s critical that the IRS provides information to people in multiple languages and formats to help them meet their tax responsibilities and receive important tax credits,” said Commissioner Rettig.

“This is another milestone in our ongoing efforts to expand our assistance to more people. I’m extremely proud of our employees’ significant efforts and strong desire to make a huge, positive difference in this area during the last several years, which has been assisted by our partners in the nation’s tax community. We are proud to continue focusing on this area.”

The IRS is building a library of multilingual resources for taxpayers. These now include:

- The Let Us Help You page is available in seven languages.

- A Spanish language version of Form 1040 and the related instructions are also available.

- Form 1040 Schedule LEP, in English and Spanish, with instructions available in English and 20 other languages, can be filed with a tax return by those taxpayers who prefer to communicate with the IRS in another language.

- The Taxpayer Bill of Rights, outlined in Publication 1, Your Rights as a Taxpayer, is available in 20 languages.

- Taxpayers can view and download several tax forms and publications, such as Publication 17, Your Federal Income Tax, in Spanish, Chinese Simplified, Chinese Traditional, Korean, Russian and Vietnamese.

The IRS website says the AMC is busy trying to bring the agency’s vital help documents and forms into a true multilingual state, but for now, basic tax information is being offered in 20 languages other than English, including:

- Spanish

- Korean

- Tagalog

- French

- Khmer

- Chinese Traditional

- Simplified Chinese

- Vietnamese

- Russian

- Arabic

- Haitian-Creole

- Portuguese

- Polish

- Farsi

- Japanese

- Gujarati

- Punjabi

- Urdu

- Bengali

- Italian

Alternative media resources

Blind or sight-impaired taxpayers can get forms and instructions a couple of ways. They can choose to download them from the IRS’ Accessible Forms and Publications webpage on IRS.gov or call 800-TAX-FORM (800.829.3676).

Tax forms and publications are available in a number of formats:

- Text-only

- Braille-ready files

- Browser-friendly HTML

- Accessible PDF

- Large print

Taxpayers can choose to get letters or notices from the IRS in Braille, large print, audio or other electronic formats by filing a completed Form 9000, Alternative Media Preference with their completed tax return.

The Form 9000 can also be sent as a stand-alone form, or taxpayers can call 800.829.1040 to make their media type selections. Spanish Braille and large-print formats are also available.

For those taxpayers who have received a printed notice or letter from the IRS but would rather receive communications in Braille, large print, audio or text, and haven’t filed their preferences with the IRS, there are options to make those choices:

1. Fax a notice with a cover sheet to the AMC at 855.473.2006. Taxpayers should put their name on the coversheet along with their address, phone number and the format they would like to receive.

2. Mail their notice or letter to the AMC. Taxpayers should include a note with their preferred communications format to:

IRS Alternative Media Center

400 N. 8th St., Room G39

Richmond, VA 23219

3. Call the IRS Accessibility Helpline at 833.690.0598. IRS representatives can help transcribe the information and set up the taxpayer’s preferences for communications.

The Information About the Alternative Media Center webpage has more details on the AMC on IRS.gov.

The Accessibility Helpline (833.690.0598) is available to help with any questions concerning the IRS’ accessibility services, and can help multilingual taxpayers with its over-the-phone interpreter service.

Note, however, that the helpline does not have access to taxpayer IRS accounts, so taxpayers needing help with issues such as tax law, refunds or other account-related issues, should visit the Let Us Help You webpage on the IRS website.

Sources: IR-2022-58; Let Us Help You – Languages

– Story provided by TaxingSubjects.com

by Ameritax | Mar 12, 2022 | Tax Tips and News

While most things have been getting more expensive lately—gasoline, food, rent, you name it—higher education has been pricey for a long time.

But because an advanced degree or some other specialized job training is vital to the career plans of many people, two education tax credits have been put in place to dull the impact of higher education costs: the American opportunity tax credit and the lifetime learning credit.

These credits are available to qualified taxpayers when they file their tax year 2021 returns now. Tax benefits could be available not only for the qualified taxpayer, but also for their spouses or dependents.

Either credit can be brought into play by filing Form 8863, Education Credits, with a 2021 tax return.

How do the credits work?

Both the American opportunity tax credit and the lifetime learning credit reduce the amount of tax the qualifying taxpayer owes. If their tax is reduced to less than zero, the taxpayer might even get a refund, depending on the credit they claim.

Generally, a taxpayer has to have a Form 1098-T from an eligible educational institution to claim either of the two credits, although there are some exceptions.

The American opportunity tax credit is worth a maximum of up to $2,500 for each eligible student. The credit is best for students pursuing their first four years of college at an eligible college or vocational school. Qualifying students are working toward a degree or some other recognized education credential.

This credit is partially refundable, in that taxpayers could get as much as $1,000 back for each eligible student.

The lifetime learning credit is oriented more toward those seeking a postgraduate degree or to improve job skills. This credit is worth up to $2,000 per tax return per year, no matter how many qualified students the taxpayer may have.

The credit is open to all years of postsecondary education and job skills training.

The lifetime learning credit is available to qualified taxpayers for an unlimited number of years.

The Interactive Tax Assistant tool on the IRS website can be used to determine which credit is best for any taxpayer.

Additional information can be found on IRS.gov on the Compare Education Credits webpage, and in Publication 970, Tax Benefits for Education.

Source: IRS Tax Tip 2022-38

– Story provided by TaxingSubjects.com

by Ameritax | Mar 12, 2022 | Tax Tips and News

The Internal Revenue Service is relying on technology to help it keep up with its growing need for taxpayer support. The agency has begun using voice and chat bots on a pair of specialized telephone assistance lines and on its website.

These new features are expected to help taxpayers get answers to simple payment or collection notice questions quickly, while avoiding wait times for a human representative.

Taxpayers can, of course, still remain on the line for an IRS telephone representative if they really need one.

“Our phone lines continue to see unprecedented demand, and the IRS continues to look for ways to help people and avoid long wait times,” said IRS Commissioner Chuck Rettig. “Our telephone representatives remain an important part of the service we provide, but these bots can help some people avoid lengthy phone delays for something that could be resolved on the spot. This is part of a larger effort to help people get the assistance they need this tax season.”

The voice and chat bots have been deployed in English- and Spanish-speaking versions, giving taxpayers help with tax payment issues, or with an IRS notice they have received. Taxpayers with more general tax season questions probably won’t encounter one of these bots at this time, the IRS says.

The bots are helping taxpayers with issues such as how to make one-time payments, answers to frequently asked questions, or clarification of collection notices.

So, what is a ‘bot,’ anyway?

Bots are basically software; in this case, software powered by artificial intelligence (AI). Voice bots allow the caller to navigate through the system of menus – called the interactive voice response system or IVR – using their voice and their natural language.

Chat bots can simulate human conversation, interacting through text. Like the voice bot, chat bots use AI to respond to natural language in a normal way.

Some taxpayers, of course, may need to speak to a human customer service representative. Those callers who do need human assistance will be placed on hold for either English or Spanish telephone assistance.

The voice and chat bots deployed by the IRS provide unauthenticated services, which means they are not able to help with issues that involve a taxpayer’s protected account information.

But for many taxpayers, the bots can be a welcome shortcut to easy answers.

“Voice and chat bots interact with taxpayers in easy-to-follow ways, which means taxpayers don’t have to wait on hold to handle simple tasks,” said Darren Guillot, Commissioner of Small Business/Self Employed Collection at the IRS.

This new IRS deployment builds on previous AI experience. The IRS used voice bots to help callers to its Economic Impact Payment (EIP) toll-free line, where they gave general answers to frequently asked questions. In February, voice bots were used on the Advance Child Credit toll-free line, giving similar help to taxpayers reconciling the credits on their 2021 tax return.

The IRS plans to add more bots in the future

Look for more bots within the IRS experience later this year. The IRS expects to have voice bots help taxpayers authenticate their identity so they can establish payment plans, request transcripts and to get information such as payoff amounts from their accounts.

And the IRS expects to have more voice and chat bots on the job later in 2022 helping taxpayers with even more complex issues.

The IRS bot rollout carries the promise of big dividends for the agency’s customer service departments. The IRS toll-free telephone lines get millions of calls every year. The average customer service representative spends some 20 minutes with every taxpayer they help with a collection issue.

If the bots can field the simple questions, that frees customer service representatives to deal with the more complex issues while cutting wait times for callers.

For more information, see the other self-service options available on the IRS website.

Source: IR-2022-56

– Story provided by TaxingSubjects.com

by Ameritax | Mar 11, 2022 | Tax Tips and News

With tax season in full swing, the Internal Revenue Service wants taxpayers to be sure they’re not overlooking ways they could lessen their tax liabilities. To take advantage of one method, though, taxpayers have to be fairly quick, because there’s a deadline to meet.

The road to deductions in this case is through contributions to an Individual Retirement Arrangement (IRA) made through April 18.

How do taxpayers qualify for IRA deductions?

By definition, an IRA is a personal savings plan, letting employees and the self-employed save for retirement and enjoy some tax advantages. Contributions can be made for 2021 to a traditional IRA or to a Roth IRA until the filing deadline of April 18, but the contributions have to be designated for 2021 to the financial institution.

Eligible taxpayers can contribute as much as $6,000 to an IRA for the 2021 tax year in most cases. If the taxpayer is age 50 or older, the limit goes up to $7,000.

Qualified contributions to traditional IRAs can be deductible right up to the contribution limit, or 100% of the taxpayer’s compensation, whichever is less.

While there used to be an age limit for making a contribution to one’s IRA, that’s no longer the case.

Taxpayers may be able to claim the Saver’s Credit, if they make qualified contributions to one of a specific group of retirement plans; this includes a 401k, 403(b), an IRA, or an Achieving a Better Life Experience (ABLE) account.

The amount of the credit—also known as the Retirement Savings Contributions Credit—is usually based on how much money the taxpayer contributes, their adjusted gross income and filing status.

The lower the income, the higher the amount of the tax credit. While taxpayers are eligible for the credit, dependents and full-time students aren’t.

Read Publication 907, Tax Highlights for Persons with Disabilities, for more information on annual contributions to an ABLE account.

There are different rules for Roth

Contributions to a Roth IRA aren’t deductible, but this type of IRA carries a different kind of benefit, allowing qualified distributions that are tax-free.

Taxpayers can make contributions to their own traditional IRA and/or Roth IRA, even if they already participate in a retirement plan sponsored by their employer. This includes SEP or SIMPLE IRA-based plans.

The IRS website has more information on contributions to retirement plans and possible deductions, including:

Source: IR-2022-52

– Story provided by TaxingSubjects.com

Ameritax

Ameritax